1. Positive Momentum in U.S. Markets, Gold Retracts

On Monday, U.S. stocks closed in positive territory, while gold experienced a decline as investors anticipated crucial inflation data and the commencement of the U.S. Federal Reserve’s two-day monetary policy meeting.

2. U.S. Stock Indexes Reach Highest Close of the Year

All three major U.S. stock indexes exhibited upward momentum throughout the day, concluding the session at their peak closing levels for the year.

3. Gold Drops to Near Three-Week Low

Concurrently, gold slid to a nearly three-week low, influenced by a strengthening dollar.

4. Market Sentiment and Upcoming Uncertainties

The upcoming week is marked by significant events, including the release of crucial economic data and central bank meetings. Notably, the Bank of Japan’s anticipated shift to a less dovish policy led to a weakening yen for the second consecutive day.

5. Focus on U.S. Inflation Data and Fed Meeting

Market attention is directed towards the U.S. Labor Department’s Consumer Price Index (CPI) report scheduled for Tuesday. The report is expected to indicate ongoing cooling of inflation while remaining above the Fed’s 2% annual target. The Federal Reserve’s two-day monetary policy meeting will conclude on Wednesday, featuring its interest rate decision and the release of summary economic projections.

6. Expectations from the Fed and Global Central Banks

Although the Fed is expected to maintain the Fed funds target rate, investors will closely scrutinize the central bank’s dot plot and summary economic projections for insights into its future trajectory. This week also sees interest rate decisions from the European Central Bank (ECB) and the Bank of England (BoE), introducing the possibility of divergence in central bank policies.

7. Performance of Major U.S. Indexes

The Dow Jones Industrial Average rose by 0.43% to 36,404.93, the S&P 500 gained 0.39% at 4,622.44, and the Nasdaq Composite experienced a slight drop of 0.24% to 14,432.49.

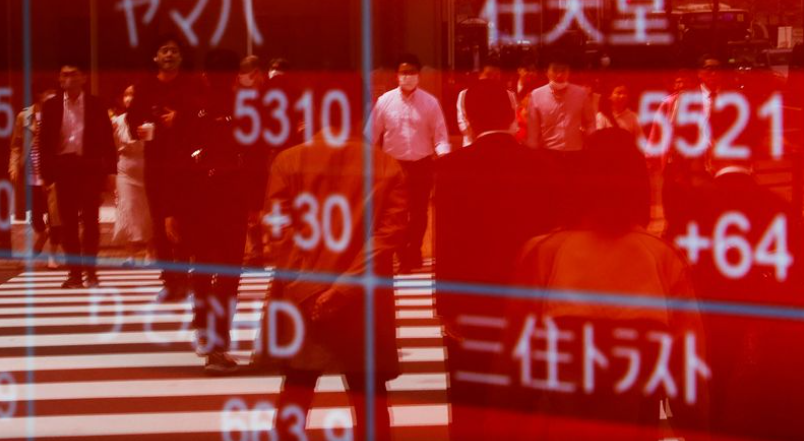

8. Global Market Overview

European shares made modest gains in anticipation of critical U.S. economic data and central bank decisions. The pan-European STOXX 600 index rose by 0.30%, while MSCI’s global stock gauge gained 0.29%. Emerging market stocks incurred a 0.15% loss, and MSCI’s Asia-Pacific index fell by 0.21%, except for Japan’s Nikkei, which rose by 1.50%.

9. U.S. Treasury Yields and Greenback Movement

U.S. Treasury yields exhibited little change after 3- and 10-year note auctions. The greenback edged higher against a basket of currencies ahead of the CPI report, while the yen faced a decline due to diminishing expectations of a less dovish monetary policy from the Bank of Japan.

10. Oil Prices and Gold Movement

Oil prices saw a slight rise as investors balanced concerns over OPEC+ production cuts with worries about softening demand in the coming year. U.S. crude settled at $71.32 per barrel, marking a 0.1% increase, while Brent ended 0.3% higher at $76.03 per barrel. Gold reached a near three-week low as focus shifted to the upcoming CPI report, with spot gold dropping by 1.1% to $1,980.91 an ounce.